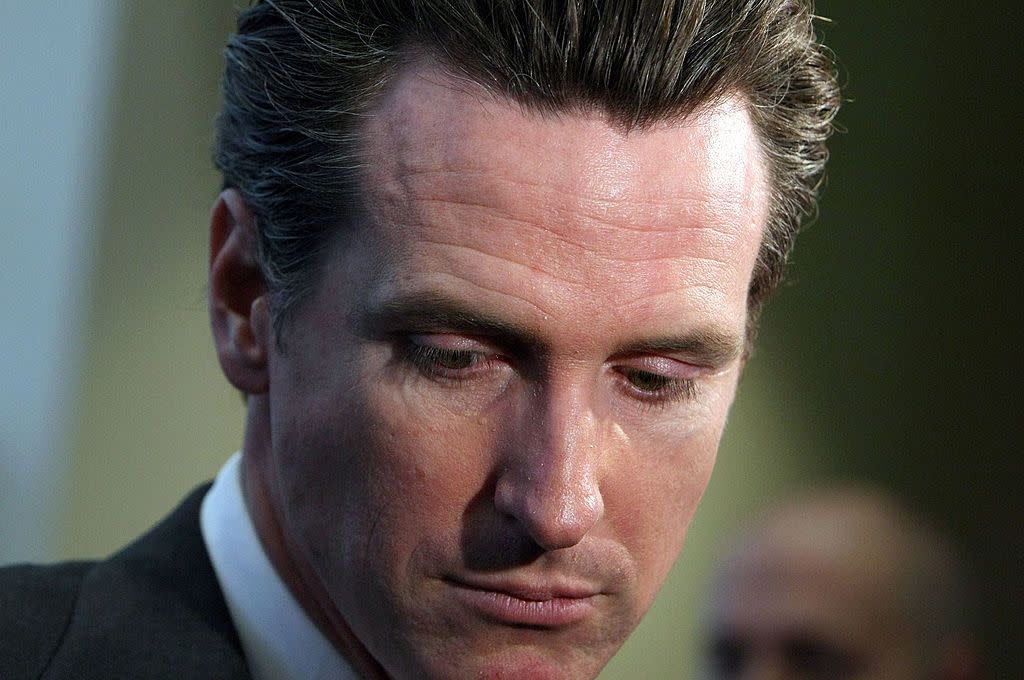

(Bloomberg Opinion) -- Looked at one way, Gavin Newsom’s dilemma is actually quite enviable. Choosing which hedge fund you get to disappoint is something many would relish. But the California governor finds himself boxed in on determining what happens next with bankrupt utility PG&E Corp.

Newsom must decide whether to support the company’s latest plan to emerge from chapter 11, which includes a revised $13.5 billion settlement agreed last week with wildfire victims. Having also settled with insurance firms for $11 billion and local governments for $1 billion, PG&E has effectively tightened pressure on one of the last remaining stakeholders — sitting in Sacramento — to get on board. In the background, a clock ticks toward the effective June 2020 deadline enshrined in California’s wildfire-fund legislation.

On Thursday, Elliott Management Corp., part of the bondholders’ committee pushing a rival exit plan, put a shot across the bow of the company, but it was ultimately also aimed at the governor’s mansion. Elliott lists multiple criticisms of the company’s plan, ranging from implications for PG&E’s governance and culture to the impact on the company’s balance sheet, cash flow and, thereby, ratepayers. Just so Newsom (and his constituents) have the full picture, you understand.

One of the interesting items in Elliott’s statement is that it no longer would require the new PG&E to carry debt at the holding-company level. Previously, it had penciled in $5.75 billion that would be replaced with additional equity commitments from several mutual funds, according to people familiar with the plan. PG&E’s own proposal calls for $7 billion. Prior to the wildfires that pushed PG&E into bankruptcy, this debt amounted to just $650 million.

This so-called “holdco” debt is different from the $27 billion or so that would be carried by the actual regulated utility assets. As such, it effectively relies on the dividend paid up to the parent by the operating company — an operating company that faces years of high spending to alleviate wildfire risk and, of course, the ongoing risk of those wildfires (albeit with a new insurance fund to mitigate that).

Even before Elliott’s announcement it was ditching the holdco debt, Andy DeVries, an analyst at CreditSights, was skeptical as to who would want to buy such paper under either plan, especially at the 4% coupon PG&E had penciled in. He points out that if the $7 billion found buyers at, say, 6%, that would represent a $420 million interest payment versus the operating company’s average dividend payment from 2014-17 of $795 million. Tax-adjusted, the roughly $300 million would absorb 12% of the new PG&E’s net income(1).

This gets at one of the main battlegrounds in PG&E’s bankruptcy: the obligations on the emergent company’s cash flows and what this means for existing shareholders, creditors and ratepayers. The bondholders’ committee, including Elliott, has from the start pushed for more expansive payments to victims funded by a lot of new equity, giving it ownership of the company and diluting existing shareholders down to virtually zero. Conversely, the latter have gradually raised their compensation offer to match the bondholders’, but structured with other financing — such as holdco debt or securitized bonds — to help preserve their ownership. The latter’s Achilles heel has always been the prospect of PG&E emerging from chapter 11 burdened with new obligations that exist partly to shield shareholders from the total wipe-out often experienced in a bankruptcy (see this).

Nonetheless, last week’s settlement by the company was a serious tactical blow to the bondholders. So their latest move to ditch the holdco element appears designed to once again highlight this issue of post-bankruptcy burdens on PG&E, and give Newsom pause. The feasibility of that holdco debt is doubtful. Possibly, the company hopes it could be replaced or offset at some point either with securitized bonds (although that effort got nowhere over the summer) or even eventual recovery of costs related to the Tubbs Fire via rates, if regulators allowed it.

For Newsom, both choices carry risks, not least because both involve some sort of reward for politically unpalatable hedge funds. On the other hand, unless he really plans on pushing for state or municipal ownership — which is no silver bullet — the need for viable public-market financing means he would have to get over that anyway.

The bondholders’ plan, if its commitments hold up, still has the benefit of a less-levered utility emerging from chapter 11. On the other hand, the company’s careful assembly of settlements with the main claimants allows it to argue it can get PG&E out of bankruptcy — and off Newsom’s desk — relatively soon. Newsom may try to split the difference by conditioning approval on more concessions from the shareholder group, such as finding a palatable (if dilutive) alternative to that holdco debt. In any case, Elliott’s salvo was aimed with precision.

(1) This assumes a $48 billion regulatory asset base, 52% equity financing and 10.25% allowed return on equity.

To contact the author of this story: Liam Denning at ldenning1@bloomberg.net

To contact the editor responsible for this story: Mark Gongloff at mgongloff1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Liam Denning is a Bloomberg Opinion columnist covering energy, mining and commodities. He previously was editor of the Wall Street Journal's Heard on the Street column and wrote for the Financial Times' Lex column. He was also an investment banker.

For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Business - Latest - Google News

December 13, 2019 at 02:17AM

https://ift.tt/34mZBgt

Elliott’s PG&E Plan Aims Carefully at Gavin Newsom - Yahoo Finance

Business - Latest - Google News

https://ift.tt/2Rx7A4Y

Bagikan Berita Ini

0 Response to "Elliott’s PG&E Plan Aims Carefully at Gavin Newsom - Yahoo Finance"

Post a Comment