On Feb. 13 after market close, Nvidia Corp. (NASDAQ:NVDA) released its earnings for its fourth quarter and full fiscal 2020.

The company reported adjusted earnings per share of $1.89 (up 136.25% year over year) and revenue of $3.11 billion (up 40.72% year over year). Net income rose 67.55% to $950 million. These numbers are far above analyst expectations of $2.97 billion in revenue and earnings per share of $1.67.

- Warning! GuruFocus has detected 8 Warning Signs with NVDA. Click here to check it out.

- NVDA 30-Year Financial Data

- The intrinsic value of NVDA

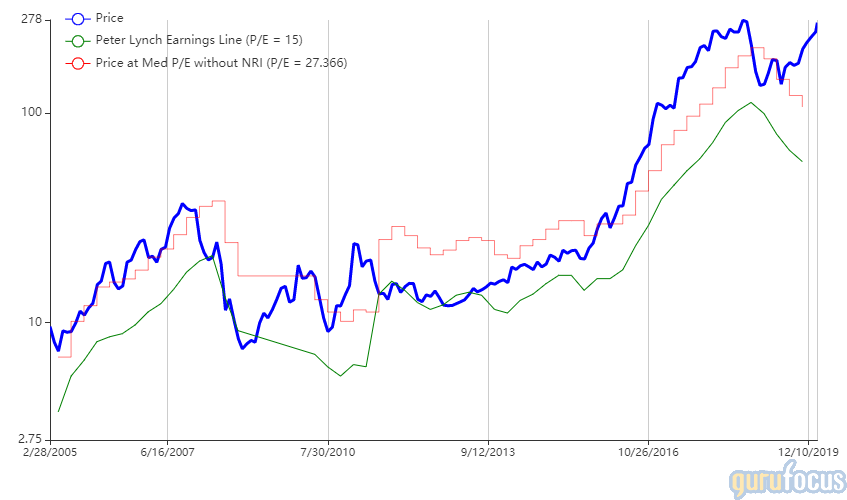

- Peter Lynch Chart of NVDA

Nvidia is a Santa Clara, California-based technology company that designs graphics processing units (for video games, marketing, etc.) and system-on-a-chip units (for mobile computing, automotive, etc.). It is the company that sparked the growth of the PC gaming market in 1999. More recently, it has developed the GPU-accelerated deep learning framework for artificial intelligence applications.

Shares of Nvidia traded around $270.58 on Feb. 13 for a market cap of $174.22 billion and a price-earnings ratio of 69.45. The stock was up 6.38% for the day in after-hours trading, though it closed slightly down.

The company has a GuruFocus financial strength score of 8 out of 10 and a profitability score of 9 out of 10. The Peter Lynch chart indicates that the stock is overvalued.

Quarter overview

Below is a chart of Nvidia's quarterly revenue and net income history, which shows that the company is close to recovering to pre-2019 levels.

Factors such as a decline in the market for PC gaming and the trade war between the U.S. and China ate into Nvidia's profits significantly in 2019, but new growth is being driven by data centers that use its hardware for artificial intelligence calculations and cutting-edge graphics innovations that simulate the real-time behavior of light.

"Adoption of NVIDIA accelerated computing drove excellent results, with record data center revenue. Our initiatives are achieving great success," founder and CEO Jensen Huang said on the earnings call. Data center revenue was up 42.56% to $958 million compared to the previous quarter.

Guidance for the next quarter

Nvidia has slightly lowered the guidance for the first quarter of fiscal 2021 in light of the new coronavirus outbreak in China, which it expects to cut into the sales of its products in the region. The company now guides for $3 billion in revenue, which would represent a 2% decline from the recent quarter.

Disclosure: Author owns no shares in any of the stocks mentioned.

Read more here:

- Ken Fisher's Top 4th-Quarter Buys

- PepsiCo Posts 4th-Quarter Revenue Beat and Earnings Loss

- 3 Undervalued 'Magic Formula' Stocks

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

- Warning! GuruFocus has detected 8 Warning Signs with NVDA. Click here to check it out.

- NVDA 30-Year Financial Data

- The intrinsic value of NVDA

- Peter Lynch Chart of NVDA

Business - Latest - Google News

February 14, 2020 at 05:55AM

https://ift.tt/323hYaJ

Nvidia Blows Past Earnings Estimates on AI Success - Yahoo Finance

Business - Latest - Google News

https://ift.tt/2Rx7A4Y

Bagikan Berita Ini

0 Response to "Nvidia Blows Past Earnings Estimates on AI Success - Yahoo Finance"

Post a Comment